State Sales Tax Revenues Are Understated by More Than $100 Million.

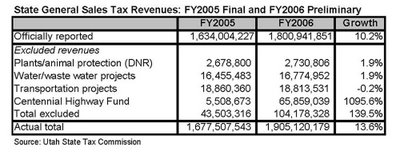

If you ask a legislator or almost anyone involved in Utah public policy how much the state collects in sales taxes, they’ll look at page one of the TC-23 and tell you that the state collected about $1.8 billion in FY2006, a 10.2% increase over FY2005.

The TC-23 is the most anticipated and viewed periodic fiscal report issued by state government.

Unfortunately, the TC-23’s main chart significantly understates by about $104 million the amount of revenue the state receives from the 4.75% general sales tax. The growth rate is also understated. The numerous sales tax earmarks are excluded in the main chart and are reported in the footnotes that hardly anyone reads.

Only a few people know about this. Most legislators and policy wonks are completely unaware of this. The following table shows how much the state really collected in sales tax .

Earmarking of general sales tax revenues began in earnest in the mid-1990s, and it has increased in recent years. Consequently, as earmarking has increased and these revenues are not reported in the TC-23 main chart, the actual growth rate in state sales tax revenues is higher than reported. Some legislators have mentioned that state sales tax revenues grew by “only” 10.2%, as cited in the TC-23. Actually, this is a significant increase, almost double the rate of inflation and population combined. However, the actual growth rate in state sales tax revenues was even higher at 13.6%, not 10.2%.

Most people would agree that $104 million is a lot of revenue to underreport. However, the big government types would argue that this really isn’t a lot of money. Afterall, $104 million amounts to

- About one and a half movie tickets per Utah household per month

- About two and half tanks of gas per Utah household per year

- About one cheeseburger per Utahn per fortnight

- About 11.5 cents per Utahn per day

I don't see why you guys have to make such a big deal about this. If the state is not reporting these revenues, it's because they have a good reason. That should be good enough for you guys

Posted by Anonymous |

2:09 PM

Anonymous |

2:09 PM

Shut up Butthead.

Posted by Anonymous |

3:25 PM

Anonymous |

3:25 PM

I'm excited to see this blog. Welcome to the blogosphere.

Posted by pramahaphil |

4:42 PM

pramahaphil |

4:42 PM

Likewise.

Posted by The Senate Site |

11:45 PM

The Senate Site |

11:45 PM

The taxpayer assostion is nothing more than a bunch of corperations that say that they are taxpayers, when in reality they have the biggest tax breaks in the state and don't pay their fair share.

Posted by Anonymous |

3:31 PM

Anonymous |

3:31 PM

Not surprisingly, some one that misspells corporation and association probably doesn't understand that taxing businesses is just a way to impose taxes on customers, employees, and shareholders without these groups actually noticing it.

Repeat after me: "corperations" (sic) don't pay taxes. People pay taxes.

Posted by Anonymous |

4:04 PM

Anonymous |

4:04 PM